Smart Philanthropy: Why Lodha's Promoters Gifted Shares to Lodha Philanthropy Foundation

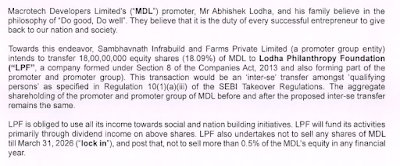

Macrotech Developers Limited (MDL), operating under the brand name Lodha, is India’s leading real estate developer and is listed on both the BSE and NSE. In a significant move on October 28, 2024, Sambhavnath Infrabuild and Farms Private Limited (SIFPL), a promoter group entity of MDL, announced the transfer of 18 crore equity shares (18.09% stake) to the Lodha Philanthropy Foundation (LPF), a Section 8 company registered under Section 12A of the Income tax Act, 1961 ('the Act').

LPF, a

part of the MDL promoter group, is actively engaged in philanthropic

initiatives, focusing on education, skill development, and women's empowerment.

The transaction was structured as a gift, reflecting the promoters’ commitment

to nation-building and social responsibility. However, this transaction raised

key questions:

- Why was the transfer made to

a Section 12A registered trust?

- Why were the shares not sold

in the open market and then the proceeds donated?

To answer

these, we must analyze relevant provisions of the Income Tax Act, 1961, and understand

their implications on SIFPL and LPF.

Tax Implications for the Transferor (SIFPL)

Definition of Transfer & Capital Gains Tax

- Section 2(47) of the Act defines

'transfer' to include sales, exchanges, relinquishments, or extinguishments

of rights in a capital asset.

- Section 2(14) of the Act defines a

capital asset as any property held by an assessee, not necessarily linked

to a business or profession.

- Gifting of shares results in

extinguishment of rights, wherein the the transferor extinguishes the following rights:

- Right to receive dividends.

- Right to vote in company

resolutions.

- Right to claim a share of

the capital in case of liquidation.

- Section 45 of the Act imposes capital

gains tax on profits from the transfer of a capital asset.

- However, Section 47(iii) of the Act exempts gifts, wills, and transfers to irrevocable trusts from capital

gains taxation.

Thus, SIFPL

is not liable for capital gains tax on the transfer of shares, in the nature of gift, to LPF.

Impact of the 2024 Amendment

The

Finance (No. 2) Act 2024, amended section 47 of the Act effective from April 1, 2025, limiting the Section 47(iii)

exemption only to individuals and Hindu Undivided Families (HUFs) thereby excluding

companies and other entities. Since SIFPL completed its transaction before this deadline, it

remains tax-exempt.

Tax Implications for the Transferee (LPF)

Receipt of Shares

- Section 56(2)(x) of the Act taxes the

fair market value (FMV) of assets received without consideration if

exceeding ₹50,000.

- Shares are covered under the

definition of 'property' in Section 56(2)(x) of the Act.

- However, Proviso (VII) to

Section 56(2)(x) of the Act exempts trusts registered under Section 12A of the Act from this

tax.

- Since LPF is a Section 12A registered entity, it is not taxed on the receipt of shares.

Income from Shares (Dividends)

- Section 11 of the Act provides tax

exemption to charitable institutions if at least 85% of their income is

applied towards charitable activities.

- Any unspent portion of the

85% can be carried forward for five years if invested per Section 11(5) of the Act.

- Hence, LPF remains

tax-exempt if dividends received are utilized for philanthropic activities.

Why Gift Shares Instead of Selling & Donating

the Proceeds?

Scenario: Selling the Shares

- MDL shares were valued at ₹1,230

per share at the time of this transaction.

- Total market value of 18

crore shares = ₹22,141 crore.

- Assuming an acquisition cost

of ₹10 per share, taxable capital gains = ₹21,961 crore.

- Capital gains tax at 15%

= ₹3,283 crore.

- Even if the sale proceeds

were donated to an 80G-registered trust, tax liability would still exist,

as income arising from long-term capital gains are not eligible for deduction under Section 80G.

- Additionally, selling the

shares in the market would dilute promoter holdings, reducing control over

the company.

Scenario: Gifting the Shares

- No capital gains tax under

Section 47(iii) (before April 1, 2025).

- No tax on LPF under Section

56(2)(x) due to 12A registration.

- Retains promoter influence

while funding philanthropic causes because LPF is a promoter group entity.

- MDL announced a dividend of ₹2.25

per share during the FY 2023-24 , generating an annual dividend income of ₹40.5 crore on the holdings of 18 Crore shares. If MDL continues to announce dividends of ₹2.25 per share, this would result in annual cash inflow of ₹40.5 crore for

LPF.

- LPF can utilize ₹34.5 crore (85%) of the ₹40.5 crore dividend income for social initiatives and still retain its tax-exempt status while accumulating the balance ₹6 crore (15%).

Key Takeaways

- Tax Efficiency: By gifting instead of

selling, SIFPL avoided capital gains tax, and LPF remained exempt under section 56(2)(x) for it being a section 12A registered entity.

- Strategic Philanthropy: LPF receives tax-free

dividend income to fund charitable causes while the promoters maintaining their shareholding in the company.

- Timing Matters: Completing the transfer

before April 1, 2025, ensured eligibility under the old Section 47(iii)

exemption.

Conclusion

This case

exemplifies how well-structured philanthropy can achieve dual

objectives—nation-building and optimized tax outcomes.

For wealthy individuals looking to give back to the society, setting up

Section 12A-registered trusts offers an effective route to maximize impact

while maintaining financial efficiency.

Reference

Corporate Announcement made by MDL on October 28,2024 regarding the transfer of shares by SIFPL to LPF

Crazy maam, good case study, intadu inna kalsu

ReplyDelete