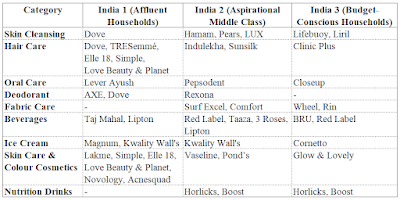

Bridging India’s Diversity: How HUL Connects with Every Household Through the India 1-2-3 Framework

The 2025 Indus Valley Annual Report by Blume Ventures provides a powerful lens through the India 1-2-3 framework, segmenting consumers into

- India 1 (affluent households)

- India 2 (aspirational middle class)

- India 3 (budget-conscious households).

|

| The India 1-2-3 framework |

India 1 (Affluent Households):

- % of total population: Represents the top 10% of the population

- Characteristics: High disposable income, global exposure, and premium brand affinity.

- Consumer Behavior: Preference for quality, brand experience, and lifestyle-driven choices.

- Targeted Products: Premium and aspirational brands with a focus on luxury, convenience, and innovation.

India 2 (Aspirational Middle Class):

- % of total population: The next 23% of the population, often emerging middle class.

- Characteristics: Value-conscious yet willing to trade up for quality. Predominantly urban and semi-urban population.

- Consumer Behavior: Balances affordability with aspirations; seeks branded products that offer quality at a reasonable price.

- Targeted Products: Mass-premium brands that promise value, quality, and a touch of aspiration.

India 3 (Budget-Conscious Households):

- % of total population: The remaining 67% of the population, includes rural and lower-income segments.

- Characteristics: Highly price-sensitive, focus on basic needs, and value-driven.

- Consumer Behavior: Prioritizes affordability and utility over brand image, often influenced by local products.

- Targeted Products: Economical and utility-focused brands that address basic needs with reliability.

Hindustan Unilever Limited (HUL) has long been a cornerstone of Indian households, with its brands woven into the daily lives of millions. As India’s market landscape evolves, understanding its diverse consumer base is key.

|

| Brands marketed by HUL |

Showcasing HUL’s Brands Across Categories To better visualize HUL’s vast portfolio and its connection to the India 1-2-3 framework, here’s a detailed breakdown of HUL brands across different categories:

|

| Brands marketed by HUL bifurcated into India 1-2-3 framework |

Let's explore how HUL skillfully aligns its brands to meet the distinct needs of every Indian family as outlined in the 2025 Indus Valley Annual Report by Blume Ventures.

Category -

Skin Cleansing

Dove targets

the urban, affluent consumers with a focus on premium quality and self-care

serves the demands of India 1 (Affluent

Households) consumers. The brand with a wide range of high-quality products

including body washes, shampoos, conditioners, and creams with ingredients like

shea butter and pomegranate extracts is positioned as premium skincare brand

with a promise of gentle care and nourishment.

LUX primarily targets India 2 (Aspirational Middle Class) consumers who desire premium experiences within their budget, by offering a touch of luxury at an affordable price . LUX through the use of bollywood celebrities and glamorous advertising creates an aspirational appeal, resonating with India 2's desire for sophistication.

Premium and special edition variants of LUX attracts India 1 (Affluent Households) consumers looking for everyday luxury.

Hamam with a product strategy of affordable pricing with a promise of safety and hygiene is appealing to family-oriented consumers and Pears with a product strategy of affordable yet premium-feel product helps to bridge the gap between aspiration and affordability effectively targeting the demands and needs of India 2 (Aspirational Middle Class) consumers.

Lifebuoy and Liril serve the needs of India 3 (Budget-Conscious Households) due to their product strategy of economical Stock Keeping Units (SKUs) like smaller soap bars & sachets to fit tight budgets (Lifebuoy) and affordable pricing with a vibrant, youthful brand appeal (Liril).

Category -

Hair Care

TRESemmé with its

brand positioning of salon-like professional hair care at home and product

strategy of specialized products for different hair types and styles, offering

a high-end, aspirational feel addresses the demands of India 1 (Affluent

Households) consumers.

Simple being clean,

no-fragrance, and no-harsh-chemicals products is appealing to the conscious

consumer demands of India 1 (Affluent Households) consumers.

Love

Beauty & Planet with its brand positioning as eco-conscious

brand with a strong focus on sustainability & natural beauty and product

strategy being vegan, cruelty-free, and eco-friendly packaging perfectly

targets the demands of ethically conscious affluent class of India 1 (Affluent

Households) consumers.

Sunsilk with its

brand positioning of everyday hair care brand with a modern & youthful

appeal and Indulekha with its

brand positioning of ayurvedic hair care brand that blends tradition with

efficacy perfectly serve the needs of India 2 (Aspirational Middle Class)

consumers who seek quality products at reasonable prices, often influenced by

tradition and modernity.

Clinic Plus with is product strategy of economical packaging like sachets and small bottles to suit budget constraints and offering reliable quality at affordable prices, ensuring widespread adoption in mass markets perfectly serves the needs of India 3 (Budget-Conscious Households) consumers being price-sensitive families in rural and semi-urban areas who prioritize hygiene and value for money.

Category - Ice Cream

Magnum by

offering Belgian chocolate, limited-edition and rich flavours targets the India

1 (Affluent Households) consumers often seeking high-quality ingredients and who

see desserts as an experience rather than just consumption. The premium pricing

of Magnum also creates an aspirational appeal, positioning it as a special

treat for urban professionals and high-income families.

The media campaigns of Magnum features luxury visuals, often

celebrity endorsements, and international appeal and the availability of Magnum

is restricted to premium supermarkets, high-end retail stores, and e-commerce

platforms.

Kwality

Wall’s with its varied offerings such as cones, cups, family packs, and

frozen desserts, catering to different age groups and occasions efficiently

targets India 2 (Aspirational Middle Class) consumers and young adults who seek

delicious treats with a balance of affordability and indulgence.

Cornetto with its pricing to be accessible to all ensures it remains a go-to choice for quick treats of India 3 (Budget-Conscious Households) consumers.

Category - Nutrition

Drinks

Horlicks

and Boost primarily focus on India 2 (Aspirational Middle Class) and India

3 (Budget-Conscious Households) rather than India 1 (Affluent Households)

Horlicks with its tailored

products, such as Horlicks Growth+, Women's Horlicks, and Junior Horlicks,

meeting specific nutritional needs targets the India 2 (Aspirational Middle

Class) consumers and with the introduction of sachet formats and small jars it

makes the product accessible to low-income households effectively targeting India

3 (Budget-Conscious Households).

Boost engages with brand ambassadors like cricket stars, connecting with sports-loving households of both the India 2 (Aspirational Middle Class) consumers and India 3 (Budget-Conscious Households) consumers.

Lakme, Simple, Elle 18, Love Beauty & Planet, Novology,

Acnesquad primarily target the India 1 (Affluent Households) consumers.

Lakme regularly

introduces premium ranges, like the Lakme Absolute collection, focusing on

luxury and performance.

Simple attracts the wellness-focused audience with its no harsh chemicals and

vegan formulas.

Elle 18 creates a playful brand

image, appealing to affluent youth who love to experiment with makeup.

Love Beauty & Planet attracts

the eco-conscious affluent segment, offering environmentally responsible

products by combing beauty with a purpose featuring sustainably sourced

ingredients and eco-friendly packaging.

Novology often compared to premium

global brands, focuses on targeted skin solutions.

Acnesquad specializes in acne care,

appealing to affluent teenagers and young adults who seek effective treatments.

Vaseline appeals to practical skincare needs and being promoted as a multi-purpose product, offering value for money while ensuring effective skin protection and Pond’s has been positioned to wide range of skincare products ranging from whitening creams, moisturizers, and face washes with a focus on nourishment and affordability.

Hence, Vaseline and Pond’s effectively target the India 2 (Aspirational Middle Class) working professionals seeking trusted skincare brands with a balance of quality and affordability.

Glow &

Lovely targets India 3 (Budget-Conscious Households) consumers particularly

in rural and semi-urban areas, who desire affordable skincare with a promise of

fairness and radiance.

Conclusion

Aligning

its brands with the India 1-2-3 framework, HUL not only meets diverse needs but

also builds an enduring bond with consumers and ensures HUL remains not just a

market leader but a cherished part of Indian households.

Mr. Sudhir Sitapati in his book “The CEO Factory – Management Lessons from HUL” recounts that on a visit to a small village in rural Bihar, he had noticed that all the three shops in the village had stocked a small INR 20 bar of Dove soaps. He asked several women in the village whether they had used Dove soap. They told yes, we use it occasionally to wash our faces before we go for marriages and other rituals.

Later back at office, Sudhir checked the household panel database and realised that 73% of Dove users were low-income consumers but they accounted for only half the volumes of the brand. The equity of the brand and the availability of the INR 20 pack was making them occasional triers of the brand, but the high price was keeping them from consuming more.

Through these wide offerings HUL also ensures when consumers scale up the ladder from India 3 to India 2 they upgrade from Lifebuoy to Pears and when they scale up the ladder from India 2 to India 1 they upgrade from Pears to Dove.

What

are your favorite HUL brands, and how do they fit into your daily life? Share

your stories with us in the comments below!

References

Comments

Post a Comment