Can a person carrying on a profession or business enjoy a luxury car by not bearing the cost of owning the luxury car ?

How to own enjoy a luxury car ?

|

| The Sprit of Ecstasy |

The actual cost of owing a luxury car can be categorized into two main parts:

1) Initial cost of purchase

2) Subsequent cost

Initial cost of purchasea) Cost

b) Registration fee

c) Road Tax

d) Goods and Services Tax (GST)

Subsequent cost include

a) Fuel expenses: Luxury cars typically have lower city mileage, akin to my exam scores, but may achieve higher mileage on highways. Additionally, they require specialized fuel for engine longevity.

b) Insurance: The cost of insurance increases with the price of the vehicle.

c) Maintenance: Luxury cars demand regular maintenance, often involving specialized parts and skilled mechanics due to their advanced features and electronics.

d) Depreciation: Luxury cars depreciate faster, primarily due to their high maintenance costs, making them less attractive to prospective buyers in the used car market. They can lose up to 60% of their value within the initial five years of ownership.

e) Chauffeur: Luxury cars are typically chauffeur-driven, offering owners the convenience of enjoying the ride from the back seat.

b) Insurance - The more expensive the vehicle is, the more expensive the insurance will be.

c) Maintenance cost - – Luxury cars need regular maintenance like any other car. However, these services can cost more for luxury cars, as they may require specialised parts and more skilled mechanic. Luxury cars have more complex electronics and features that require additional maintenance.

d) Depreciation - Luxury cars are more depreciable partly because of their high maintenance costs make them less appealing to future used car buyers unless the car is a limited edition. Luxury cars tend to lose up to 60% of their value within the first five years of ownership.

e) Chauffer – Luxury cars are mainly chauffer driven. Why would the owner want to sit behind the steering wheel, when he has the option to sit at the back and enjoy the ride.

Forget vehicles, when I checked the property plant and equipment schedule of the company for the FY 2022-23, there was addition to the tune of INR 1,101 Cores under the head “Aircrafts and Helicopters”.

However, INR 43,200 (3600*12) will be perquisite in each of their hands when each of them is given only one car and that too a luxury car like Rolls Royce.

Question - How can an individual engaged in a profession or business experience the luxury of owning a car without incurring the associated expenses?

Solution - The sole requirement is for the business entity to be the rightful owner of the vehicle.

Let us understand this through a example.

ABC Ltd is a company incorporated under the Companies Act, 2013. ABC Ltd is a diversified conglomerate having well established businesses in telecom, retail, oil and refinery. Ram is the managing director, his son Sohan and daughter Hema are directors of ABC Ltd. Ram, Sohan and Hema are drawing salary from ABC Ltd for their respective roles.

The company is the registered owner of the following cars –

Rolls Royce Cullinan,

Mercedes Benz AG S 600

Mercedes AMG G 63

Initial cost of purchase such as the showroom price, road tax and GST will be borne by ABC Ltd. The above cars are purchased through bank loans at an interest rate of 8% per annum.

Through a resolution passed in the board of directors meeting Ram, Sohan and Hema are allowed to use Rolls Royce Cullinan, Mercedes Benz AG S 600 and Mercedes AMG G 63 respectively. They are allowed to use it partly in the performance of duties and partly for private or personal purposes of their own or any member of their household. A chauffeur is also provided by the employer to run the motor car.

It is also agreed that the expenses on maintenance and running will be met or will be reimbursed by their employer i.e. ABC Ltd.

We need to discuss and understand as to how the provisions of the Income Tax Act, 1961 (herein after referred to as “the Act” for brevity) will allow the directors to ride and enjoy the the luxury cars without bearing the cost of owning the luxury car .

Section 29 of the Act provides that the profits and gains of any business or profession are to be computed in accordance with the provisions contained in sections 30 to 43D.

So, while computing the income chargeable under the head ”profits and gains of business and profession” of ABC Ltd, provisions of section 30 to 43D are to be considered.

Section 31 of the Act allows deduction in respect of the expenses on current repairs and insurance premium of assets while computing the income from business or profession. In order to claim this deduction, the assets must have been used for purposes of the assessee’s own business.

Hence, ABC Ltd can claim deduction of the expenses of repairs and maintenance and insurance of the luxury cars.

Section 32 of the Act allows a deduction in respect of depreciation resulting from the diminution or exhaustion in the value of certain capital assets. The assessee claiming depreciation must own the assets.

The rate of depreciation allowed for motor cars is 15%. The cost of the asset for the purpose of section 32 would be sum of the showroom price, registration fees, road tax and GST.

Hence, ABC Ltd can claim deduction of depreciation at the rate of 15% on written down value basis from the cost of the luxury vehicle.

Section 37 of the Act allows deduction of revenue expenditure incurred for the purposes of carrying on the business or profession.

Hence, ABC Ltd can claim deduction of recurring expenses such as fuel cost, chauffeur expense and interest on loan taken for purchase of the luxury car.

According to section 17 of the Act, if motor car is provided by the employer to the employee, it will be perquisite in the hands of specified employees only. The meaning of specified employees inter-alia includes director employee. It is immaterial whether he is a full-time director or part time director.

The value of perquisite per calendar month in case of motor car provided by ABC Ltd to the directors will depend on the circumstances and the whether the cubic capacity of engine exceeds 1.6 litres or not and whether a chauffeur is also provided to run the motor car.

In our example, the circumstance is that the directors are allowed to use it partly in the performance of duties and partly for private or personal purposes of their own or any member of their household and the cars being luxury cars the cubic capacity of engine exceeds 1.6 litres and a chauffeur is also provided to run the motor car.

Then, for in our example the perquisite value per calendar month in the hands of each director will be INR 3300 (INR 2400 + INR 900).

The annual perquisite value is around INR 39,600 (3300*12). Section 80C will easily allow Ram, Sohan and Hema to claim deduction of INR 39,600 from their gross total income if they invest INR 39,600 in public provident fund within the end of the financial year.

ABC Ltd is a company incorporated under the Companies Act, 2013. ABC Ltd is a diversified conglomerate having well established businesses in telecom, retail, oil and refinery. Ram is the managing director, his son Sohan and daughter Hema are directors of ABC Ltd. Ram, Sohan and Hema are drawing salary from ABC Ltd for their respective roles.

The company is the registered owner of the following cars –

Rolls Royce Cullinan,

Mercedes Benz AG S 600

Mercedes AMG G 63

Initial cost of purchase such as the showroom price, road tax and GST will be borne by ABC Ltd. The above cars are purchased through bank loans at an interest rate of 8% per annum.

Through a resolution passed in the board of directors meeting Ram, Sohan and Hema are allowed to use Rolls Royce Cullinan, Mercedes Benz AG S 600 and Mercedes AMG G 63 respectively. They are allowed to use it partly in the performance of duties and partly for private or personal purposes of their own or any member of their household. A chauffeur is also provided by the employer to run the motor car.

It is also agreed that the expenses on maintenance and running will be met or will be reimbursed by their employer i.e. ABC Ltd.

We need to discuss and understand as to how the provisions of the Income Tax Act, 1961 (herein after referred to as “the Act” for brevity) will allow the directors to ride and enjoy the the luxury cars without bearing the cost of owning the luxury car .

Section 29 of the Act provides that the profits and gains of any business or profession are to be computed in accordance with the provisions contained in sections 30 to 43D.

So, while computing the income chargeable under the head ”profits and gains of business and profession” of ABC Ltd, provisions of section 30 to 43D are to be considered.

Section 31 of the Act allows deduction in respect of the expenses on current repairs and insurance premium of assets while computing the income from business or profession. In order to claim this deduction, the assets must have been used for purposes of the assessee’s own business.

Hence, ABC Ltd can claim deduction of the expenses of repairs and maintenance and insurance of the luxury cars.

Section 32 of the Act allows a deduction in respect of depreciation resulting from the diminution or exhaustion in the value of certain capital assets. The assessee claiming depreciation must own the assets.

The rate of depreciation allowed for motor cars is 15%. The cost of the asset for the purpose of section 32 would be sum of the showroom price, registration fees, road tax and GST.

Hence, ABC Ltd can claim deduction of depreciation at the rate of 15% on written down value basis from the cost of the luxury vehicle.

Section 37 of the Act allows deduction of revenue expenditure incurred for the purposes of carrying on the business or profession.

Hence, ABC Ltd can claim deduction of recurring expenses such as fuel cost, chauffeur expense and interest on loan taken for purchase of the luxury car.

Now you may agree that the initial cost of purchase and subsequent cost can be claimed as deduction by ABC Ltd but will the Act not catch hold of Ram, Sohan and Hema.

Yes, the Act is going to catch hold of Ram, Sohan and Hema but the impact is very minimal. Let us now see how the Act is going to catch hold of our directors.According to section 17 of the Act, if motor car is provided by the employer to the employee, it will be perquisite in the hands of specified employees only. The meaning of specified employees inter-alia includes director employee. It is immaterial whether he is a full-time director or part time director.

The value of perquisite per calendar month in case of motor car provided by ABC Ltd to the directors will depend on the circumstances and the whether the cubic capacity of engine exceeds 1.6 litres or not and whether a chauffeur is also provided to run the motor car.

In our example, the circumstance is that the directors are allowed to use it partly in the performance of duties and partly for private or personal purposes of their own or any member of their household and the cars being luxury cars the cubic capacity of engine exceeds 1.6 litres and a chauffeur is also provided to run the motor car.

Then, for in our example the perquisite value per calendar month in the hands of each director will be INR 3300 (INR 2400 + INR 900).

The annual perquisite value is around INR 39,600 (3300*12). Section 80C will easily allow Ram, Sohan and Hema to claim deduction of INR 39,600 from their gross total income if they invest INR 39,600 in public provident fund within the end of the financial year.

Now you may agree that the impact on Ram, Sohan and Hema is minimal and can even be zero.

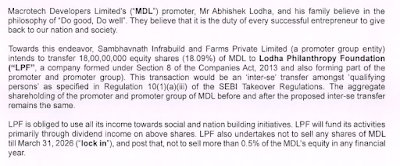

You may inquire whether I can furnish the name of the company along with evidence such as the car's name and registration number. Well, here it is:

The registered owner's name is indicated with an asterisk at specific points. It shouldn't be challenging for you to infer the company's name. If you encounter any difficulty, you can refer to the list of companies in Nifty 50 or Sensex and attempt to match it with the company's name. You'll likely find the correct match.

|

Rolls Royce Cullinan |

|

Tesla S 100D |

|

BMW 760LI Limousine |

|

Mercedes AMG G 63 |

|

Mercedes Benz AG S 400 D 4 MATIC |

|

Mercedes Benz AG S 600 |

|

Rolls Royce Phantom Extended |

These are some of the cars registered under the company's name. You might wonder how I obtained the registration numbers for these vehicles. I've provided the source for this information later in this article.

Simply searching on YouTube with the family name along with "car collections" will yield a list of videos showcasing the directors of the mentioned company enjoying these luxury cars.

Upon reviewing the "Director/Signatory Details" of the company, I found names of 16 individuals. I can confidently speculate that at least 4 out of these 16 individuals are indulging in the luxury of these cars without bearing any cost.

There was addition to the tune of INR 263 Crores during the FY 2022-23 under the head vehicles. There would definitely be purchase of atleast 2 luxury vehicles during the FY 2022-23.

Another notable example is Adar Poonawala, a director at Serum Institute of India. He has been seen driving a Rolls Royce, which is registered under the name of Serum Institute of India Private Limited.

Another notable example is Adar Poonawala, a director at Serum Institute of India. He has been seen driving a Rolls Royce, which is registered under the name of Serum Institute of India Private Limited.

Bhushan Kumar, the managing director of both Super Cassettes Industries Limited and T Series, is chauffeured in a Rolls Royce. Interestingly, the car is registered under the name of Super Cassettes Industries Limited.

Now coming back to our example, you might have a question as to what would have been if Ram, Sohan and Hema withdraw a higher amount of salary and purchased the cars themselves. They would have atleast been the registered owners.

Let us analyse this in a short and sweet manner.

No deduction in respect of repairs, insurance, depreciation, fuel expense and interest expense. On top of that pay nearly 42.70% of your income from salary as tax post Chapter VI-A deductions of the Act.

No deduction in respect of repairs, insurance, depreciation, fuel expense and interest expense. On top of that pay nearly 42.70% of your income from salary as tax post Chapter VI-A deductions of the Act.

Assuming they don't have any eligible Chapter VI-A deduction, they would earn 100 as salary, pay 42.70 as tax and then in the balance 57.30 incur initial cost of purchase and subsequent cost of purchase for a luxury car. At the end of the day, they would be left with peanuts.

Conclusion

Continuing with the same example, if ABC Ltd provides more than one motor car to Ram or Sohan or Hema and they use the cars provided for their personal purposes then the value of the perquisite in case of one car will be INR 3600 per month and for the other cars the value would be the actual amount of expenditure incurred by ABC Ltd on running and maintenance of the motor car during the year including the remuneration paid to the chauffeur and 10% per annum of the actual cost of the car.However, INR 43,200 (3600*12) will be perquisite in each of their hands when each of them is given only one car and that too a luxury car like Rolls Royce.

Source

Android app to check the registered owner name of the car (this is will also let you know if there is any pending fine on the car for breach of law) - https://play.google.com/store/apps/details?id=com.cuvora.carinfo&pcampaignid=web_share

Thank You

Happy Reading !

Comments

Post a Comment